How Buying a House with a Fixed Mortgage Can Save You Money When Prices Go Up

In the past three years, the world has witnessed a significant rise in living costs, with inflation reaching levels not seen in decades. As rental prices soar, the stability of owning a home with a fixed mortgage has emerged as a really smart money move.

The number one pro of buying a house today isn’t just getting the house itself, but in the foresight of securing a fixed mortgage payment that stays the same for the life of the loan and protects you from rising housing costs.

A fixed mortgage is like a promise that your house payment won’t change for the entire time you’re paying back the loan, even if it’s for 30 years. This means while your friends’ rent might go up every year, your payment stays the same. Especially as rental costs continue to climb— a trend that has become distressingly familiar over the last three years.

Fixed Mortgage Payments Explained

A fixed-rate mortgage is a home loan with an interest rate that stays the same for the entire term of the loan. No matter what happens in the market, your interest rate won’t change. This means your monthly mortgage payments — which include both the interest and part of the principal balance — remain consistent, making it easier to budget for your home expenses because you’ll always know what your payment will be.

Fixed-rate mortgages are popular because they’re stable and predictable, and they usually come in terms such as 15, 20, or 30 years.

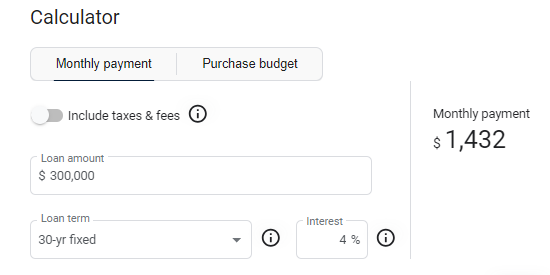

Imagine you take out a 30-year fixed-rate mortgage to buy a home for $300,000. The bank offers you a 4% annual interest rate on your mortgage.

Here’s what this would look like:

Loan amount: $300,000

Interest rate: 4% per year (fixed)

Loan term: 30 years (360 months)

Monthly payment: Fixed for the life of the loan

With these terms, you would be required to pay a fixed monthly payment for the next 30 years. Assuming there’s no mortgage insurance, property taxes, or homeowners insurance included in the payment, your principal and interest payment would be calculated based on the loan amount, interest rate, and term of the loan.

Let’s calculate the monthly payment for this example.

In the example given, for a $300,000 loan with a 4% fixed annual interest rate over a 30-year term, the monthly payment would be approximately $1,432.25. This payment covers both the interest and part of the principal balance, and it would not change for the entire 30 years of the loan term.

The biggest benefit of a fixed rate mortgage

Homeowners with fixed-rate mortgages enjoy a degree of immunity against inflation.

While rent can increase annually, a fixed mortgage payment is set in stone, offering a predictable and unchanging expense.

This stability is not just about comfort; it’s a strategic move against inflation. It allows homeowners to allocate their financial resources with greater confidence, knowing that one of their largest monthly expenditures will not rise with the tide of inflation.

It’s one less thing to worry about.

>> ARMs are ideal for short-term homeownership or those expecting a future income rise

Why rent keeps getting more expensive

Have you ever wondered why it seems like your rent goes up every year? You’re not alone. Many renters face this issue, and it’s because rent prices are tied to the housing market, which keeps changing.

The Demand for Housing: More people are looking for places to live than there are available homes. This high demand means landlords can charge more.

Costs for Landlords Go Up: Landlords have expenses like property taxes, maintenance, and insurance. When these costs increase, they often pass them on to renters.

Inflation: Just like the price of groceries and gas, rent can go up with inflation. When the cost of living rises, so does rent.

Improvements and Upgrades: If your landlord spruces up the place with a new gym or fixes the roof, that can lead to higher rent to cover those costs.

Location: If your neighborhood becomes more popular or gets better amenities, like new shops or a train station, rent prices can rise because more people want to live there.

Rent Control Laws: Some areas have rent control, but even these laws allow for rent to go up by a certain amount each year.

So, while there are many reasons rent can get more expensive, owning a home with a fixed-rate mortgage means your monthly payments stay the same, making it easier to plan your budget and future.

two case studies illustrating the difference between renting and having a fixed rate mortgage

Case Study 1: Jessica Rents in the City

Background: Jessica is a graphic designer who rents a one-bedroom apartment in a bustling city center. Her rent is $1,500 per month.

Year 1: She signs a lease with her landlord, and her rent starts at $1,500 per month.

Year 2: The landlord increases the rent by 3% due to rising market rates and property taxes, so now Jessica pays $1,545 per month.

Year 3: Another rent increase of 4% brings her monthly payment to $1,607.

Over 3 Years: Jessica has no equity built up from her rent payments, and she has paid out $55,896 in rent.

Case Study 2: Alex Buys a Suburban Home

Background: Alex, an IT consultant, buys a home in the suburbs with a 30-year fixed-rate mortgage of $1,500 per month at a 4% interest rate.

Year 1: Alex’s monthly payment remains at $1,500 per month, part of which goes towards paying down the mortgage principal.

Year 2: Despite some of his neighbors complaining about rent increases, Alex’s mortgage payment is still $1,500.

Year 3: Alex continues to pay $1,500 per month. He also benefits from a slight increase in home value due to market appreciation.

Over 3 Years: Alex has built equity in his home and has a fixed expense for housing, which has remained predictable and unchanged, and he has paid a total of $54,000 towards his mortgage, some of which has gone into building equity in his home.

In these case studies, while Jessica has faced increasing rent with no return on her money, Alex has enjoyed stable payments and has begun to build equity in his home. This illustrates the potential financial benefits of buying a home with a fixed-rate mortgage compared to renting, especially in an inflationary environment.