How To Calculate Your Monthly Mortgage Payment

Embarking on the journey of buying a home is both an exciting and significant milestone in life. It’s a path that leads to not just a place of residence but a space that resonates with personal dreams and aspirations. However, woven intricately into this dream is the reality of financial planning, particularly understanding and managing your monthly mortgage payments. For most homebuyers and homeowners, a mortgage is not just a loan; it’s a commitment that spans decades, impacting daily life and long-term financial health.

In this comprehensive guide, we delve into the crucial aspects of calculating your monthly mortgage payment. This isn’t just about numbers; it’s about empowering you with knowledge and tools to make informed decisions.

Whether you are a first-time homebuyer, considering refinancing, or just seeking to deepen your understanding of home financing, this article will navigate you through the intricacies of mortgage payments.

We’ll explore the key components that shape your monthly payment, such as the loan principal, interest rates, property taxes, insurance, and more. We will also unravel the formula behind mortgage calculation, providing you with the insight to gauge how different variables can influence your monthly financial obligations.

By understanding the nuts and bolts of your mortgage payment, you’re not just preparing to meet your financial responsibilities; you’re also setting the stage for a stable and prosperous future in your home. So, let’s begin this journey of discovery and empowerment, ensuring that your dream home aligns seamlessly with your financial goals and lifestyle.

Understanding the Components of a Mortgage payment

A mortgage payment is more than just a monthly deduction from your bank account; it’s a structured financial obligation that combines several key components. Each part plays a pivotal role in determining the total amount you pay every month. Let’s break down these components to provide a clearer understanding of what goes into a mortgage payment.

Calculating Your Mortgage Payment: The Formula

Understanding the formula for calculating your monthly mortgage payment is essential for any homebuyer or homeowner. This knowledge not only prepares you for what to expect but also empowers you to make well-informed financial decisions. The standard formula for calculating a mortgage payment is a blend of mathematical simplicity and financial complexity.

Let’s break it down:

The Standard Mortgage Payment Formula

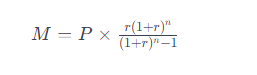

The monthly mortgage payment can be calculated using the formula:

Where:

- M is your monthly mortgage payment.

- P represents the principal loan amount (the total amount borrowed).

- r is the monthly interest rate. To find this, divide your annual interest rate by 12 (the number of months in a year).

- n is the number of payments (loan term in months). For example, a 30-year loan would have 360 payments (30 years x 12 months).

Breaking Down the Formula with an Example

Let’s apply this formula with an example for clarity:

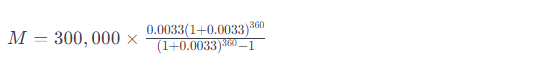

Suppose you have a $300,000 loan (the principal) with an annual interest rate of 4%, and your loan term is 30 years. First, calculate the monthly interest rate by dividing the annual rate by 12. So, 4% annually becomes 0.33% monthly (4 divided by 12). In decimal form, this is 0.0033 (0.33% as a decimal).

Now, plug these values into the formula:

- P = $300,000

- r =0.0033

- n =360 (30 years x 12 months)

By solving this, you get the monthly payment amount (excluding taxes, insurance, and other fees).

While this formula gives you a fundamental understanding of how monthly payments are calculated, it’s important to remember that other factors can also affect your payment, such as property taxes, homeowners insurance, and mortgage insurance. These are often added to the calculated monthly payment to give you the total amount you will pay each month.

Alternatively, you could opt for the simplicity and convenience of using an online mortgage calculator. These tools are user-friendly and require minimal effort, efficiently handling the complex calculations for you. By inputting basic information like the loan amount, interest rate, and loan term, a mortgage calculator can quickly provide an accurate estimate of your monthly mortgage payment, saving you time and simplifying the process. Here is one you can try out: Bankrates Calculator

- Learn why homebuyers are opting for adjustable rate mortgages

- How Buying a House with a Fixed Mortgage Can Save You Money When Prices Go Up

Factors that influence the mortgage payment

While the basic formula for calculating your mortgage payment is straightforward, several variables can significantly influence the amount you’ll pay each month.

Let’s explore the key elements that impact your mortgage payment:

- Credit Score

- Your credit score plays a critical role in determining the interest rate you’ll receive. A higher credit score often translates to lower interest rates, which can substantially reduce your monthly payment. Conversely, a lower credit score may result in higher interest rates, increasing your monthly mortgage cost.

- Loan Term Length

- The length of your mortgage, typically either 15 or 30 years, affects your monthly payments and the total interest paid over the life of the loan. Shorter loan terms usually have higher monthly payments but lower total interest costs, while longer terms spread out the payments, making them more manageable monthly but increasing the total interest paid.

- Down Payment Size

- The amount of your down payment directly affects the size of your mortgage principal. A larger down payment reduces the principal amount, leading to lower monthly payments. Additionally, a down payment of 20% or more can eliminate the need for mortgage insurance, further reducing your monthly expenses.

- Interest Rate Type

- The type of interest rate you choose – fixed or adjustable – impacts your payments. Fixed-rate mortgages offer stability with the same interest rate over the entire loan term, leading to consistent monthly payments. Adjustable-rate mortgages (ARMs) typically start with a lower interest rate, but the rate can change over time, affecting your payments.

- Adjustable-Rate Mortgage (ARM) Terms

- If you opt for an ARM, the initial interest rate and how often it adjusts are crucial. The initial rate period can vary, and once it expires, the rate adjusts at predetermined intervals. Understanding these terms helps anticipate potential changes in your monthly payments.

- Property Type and Location

- The type of property you purchase and its location can influence your mortgage payment. Some property types, like condos or multi-family homes, may have higher interest rates or require higher down payments. Additionally, the property’s location can affect property taxes and insurance rates, both of which are often included in your mortgage payment.

Additional Costs to Consider in Your Mortgage payment

When budgeting for a home, it’s essential to look beyond the principal and interest of your mortgage payment. Several other costs can significantly affect your monthly and overall housing expenses. Being aware of these costs ensures that you are fully prepared for the financial responsibilities of homeownership.

Let’s explore some of these additional costs:

- Homeowners Association (HOA) Fees

- If your property is part of a homeowners association, you will likely need to pay HOA fees. These fees vary widely depending on the community and the amenities provided, such as landscaping, pools, fitness centers, and maintenance of common areas. These fees are crucial to consider as they can be a significant addition to your monthly housing costs.

- Maintenance and Repair Costs

- Owning a home comes with the responsibility of maintaining and repairing it. This can include anything from minor repairs to major renovations and replacements, like a new roof or HVAC system. It’s wise to set aside funds regularly for these inevitable expenses to avoid financial strain when they arise.

- Utility Costs

- Utilities such as electricity, gas, water, and sewer services are additional costs that can vary depending on the size of your home, its location, and your usage. Evaluating these costs in advance can help you budget more accurately and choose a home that aligns with your financial capabilities.

- Property Upgrades and Improvements

- You may wish to make upgrades or improvements to your new home, such as remodeling a kitchen or bathroom, landscaping, or adding solar panels. These improvements should be factored into your overall budget, as they can add significant value to your home but also require upfront investment.

- Emergency Fund for Unforeseen Expenses

- It’s prudent to have an emergency fund for unforeseen expenses related to homeownership. This could include urgent repairs, natural disasters, or other unexpected situations that require immediate financial attention.

- Insurance and Tax Increases

- Be aware that property taxes and homeowners insurance premiums can increase over time, which would raise your monthly mortgage payment if they are escrowed. Keeping an eye on these changes and planning for potential increases is an essential aspect of managing your long-term financial commitments as a homeowner.